BLOG

ARTIFICIAL INTELLIGENCE AND INTELLECTUAL PROPERTY: Can creations by IA be patented?

The contemporary era is immersed in an unprecedented technological revolution, driven by the rapid advancement of Artificial Intelligence (AI). This phenomenon has transcended the boundaries of mere innovation to fundamentally redefine our relationship with technology...

APPLY FOR THE DIGITAL NOMAD VISA IN SPAIN

Requests for information about the digital nomad visa in Spain are becoming more common every day. In recent years, remote work has become a common practice in a large number of companies in all kinds of sectors: IT, marketing, finance, real estate, etc. This new...

NEW MEASURES ON THE VALIDITY OF THE CANARY ISLANDS SPECIAL ZONE: FAREWELL TO RECURRENT EXTENSIONS.

The Council of Ministers yesterday approved Royal Decree-Law 8/2023, of 27th December, adopting measures to deal with the economic and social consequences of the conflicts in Ukraine and the Middle East, as well as to alleviate the drought effects. The Royal...

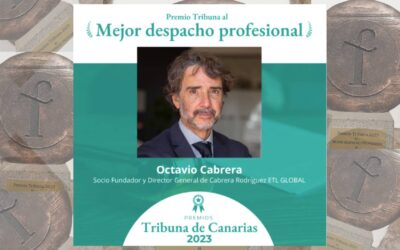

TRIBUNA AWARD FOR THE BEST LEGAL AND TAX FIRM

CABRERA RODRIGUEZ ETL GLOBAL Lanzarote, November 27th, 2023 The Tribuna Communication Group annually celebrates its traditional TRIBUNA AWARDS, recognition and awards given to people and companies that with their career and work have contributed and continue to...

INHERITANCE AND DONATION TAX

We return to the full exemption on Inheritance and Gift Tax in the Canary Islands. On the past 5thSeptember, Decree-Law 5/2023 of 4th September was published, by which the Canary Islands Government approved the exemption of the tax liability for Inheritance and Gift...

THE 10 MOST FREQUENTLY ASKED QUESTIONS ABOUT TREASURY BONDS.

The Public Treasury, a body of the Ministry of Economic Affairs and Digital Transformation, has been the focus of attention in recent days following the announcement of the issuance targets for upcoming auctions. Specifically, the Public Treasury placed 4.5 billion...

Personal Income Tax and Wealth Tax campaign 2022

On 11st April 2023, the Personal Income Tax and Wealth Tax Return Filing Campaign for the 2022 tax year officially begins. An essential aspect of the tax return is the verification of the state or autonomous community deductions that may be applicable, as well as...

Tax form 720. Informative Declaration. Declaration on assets and rights located abroad.

Next 31st of March is the deadline for submitting the Model 720 for the informative statement about assets and rights abroad corresponding to tax year 2022, for those taxpayers who are obliged to present said informative declaration. The aforementioned declaration is...

Canarian companies and VAT on electronic commerce

The initiative www.canarianmarket.com Some articles have recently appeared at the press commenting on the initiative www.canarianmarket.com, a platform aimed at facilitating the marketing through the internet of Canarian products in the national and international...

How is the Christmas lottery prize taxed?

Interview to Danaizeth Gómez, Specialist lawyer in tax law at CABRERA RODRIGUEZ ETL GLOBAL. https://www.youtube.com/watch?v=e-Yf4fvGFz4