BLOG

COVID-19 Communication from Cabrera Rodríguez

Dear clients: Given the situation we are experiencing due to the Coronavirus (Covid-19), we inform you that we have implemented all the measures within our reach to protect both clients and workers, following the recommendations of the World Health Organization and...

ETL is coming to the canaries by the hand of Cabrera Rodríguez

Translation of the Article by Laura Saiz – Madrid Photo of Carolina Rodríguez and Octavio Cabrera, responsible partners of the law firm Cabrera Rodríguez in Tenerife Since its foundation 20 years ago, the Canary law firm is specialized in the particular tax regime of...

Considerations regarding the tax developments for the Canary Islands in 2020

By Octavio Cabrera Managing Partner at CABRERA RODRÍGUEZ ETL GLOBAL. I can only agree with the need to increase the tax collection in order to cover the social program of the Canary Islands Government. However, the measures adopted do not seem to be the most...

An overview of the Canary Islands taxation: compatibilities and synergies

Octavio Cabrera Toste Lawyer of Tax Law. Managing Partner at Cabrera Rodríguez ETL GLOBAL The Economic and Fiscal Regime of the Canary Islands (REF as per the Spanish acronym) is a wide set of regulations aiming to compensate the distance, isolation and structural...

News on taxation in the Canary Islands for 2020

By: Danaizeth Gómez Díaz Lawyer at Cabrera Rodriguez Lawyers and Tax Advisers The Draft Budget Law of the Autonomous Community of the Canary Islands is in the process of submission of overall amendments within the framework of its parliamentary procedure....

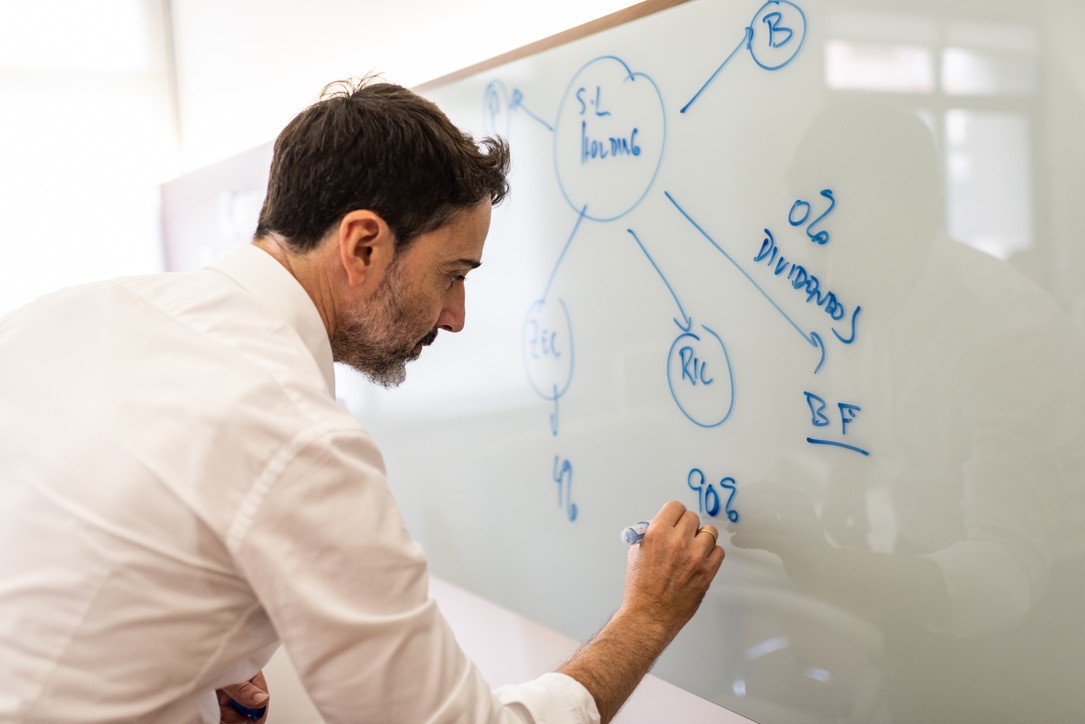

To give or not to give, that is the question

What parents, whether they are businesspeople, custodians of a family's wealth, have not at some time or other thought about the advisability of transferring part of that wealth during their lives to their children or other relatives? The probability that this thought...

Our familiy business

We, and particularly the politicians, find it difficult to stop talking about our family businesses and we refer to them as the lifeblood of our economy, the thermometer of our growth, the driving force behind job creation, almost our national source of pride. But, in...

Renting your home for tourists in the Canaries: the current legal framework

26.05.2016 The Canary Islands are long established as one of the most relevant holiday destinations in Europe due to the weather and because of the wide range of accommodation services available in the Archipelago. It is well known that the main economic activity of...

The ZEC in 2017 and its outstanding challenges

After over twenty years, it might seem almost superfluous to begin this commentary by remembering the magnificent virtues of our Special Zone, its unparalleled uniqueness in our united Europe and the importance of the competitive advantages that it provides. However,...

Establishing your business in the canary islands: the best taxation in europe

12.05.2016 In one of our last articles we mentioned that the Canary Islands Special Zone (hereinafter ZEC as per the Spanish acronym) is the most relevant tax advantage of our taxation regime on business income, which is one of the most attractive aspects of this...